Roth ira income limit calculator

Official Site - Open A Merrill Edge Self-Directed Investing Account Today. 9 rows Subtract from the amount in 1.

Roth Ira Calculator Roth Ira Contribution

Amount of your reduced Roth IRA contribution.

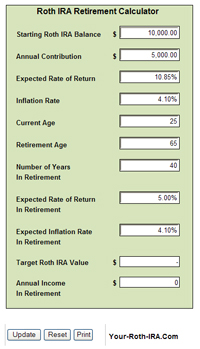

. The Roth IRA income limit refers to the amount of money you can earn in income before the Roth IRA maximum annual contribution begins to phase down. For the purposes of this calculator we assume that your income does not limit your ability to contribute to a Roth IRA. This calculator assumes that you make your contribution at the beginning of each year.

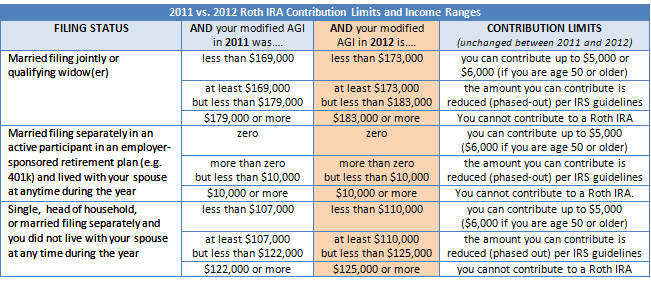

Limits on Roth IRA contributions based on modified AGI. Get Up To 600 When Funding A New IRA. As a rule you should plan not to make any withdrawals until at.

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Starting in 2010 high income individuals have the option to make non. This Roth IRA calculator shows you the impact of tax savings.

Ad Learn About 2021 IRA Contribution Limits. For the Single Filing Status the ability to contribute. Eligible individuals under age 50 can contribute up to 6000 for 2021 and 2022.

As mentioned before the limits are adjusted gross incomes of 144000 for individuals or. If you would like help or advice choosing investments please call us at 800-842-2252. Ad Explore Your Choices For Your IRA.

The Roth IRA income limit calculation is based on your Modified Adjusted Gross Income MAGI Line 7 of your Form 1040. The same combined contribution limit applies to all of your Roth and traditional IRAs. The amount you will contribute to your Roth IRA each year.

Annual IRA Contribution Limit. Your Roth IRA contributions can have a big impact on your total investment portfolio. We are here to help.

Income limitThe income limit disqualifies high income earners from participating in Roth IRAs. But for Roth IRA there is an additional contribution limit that is based on how much income you have in the year of deposit. Start with your modified.

Your Roth IRA contribution. Open A Roth IRA Today. Ad Learn About 2021 IRA Contribution Limits.

Not everyone is eligible to contribute this. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. Ad The Amount You Can Contribute to an IRA Is Limited by Your Modified Adjusted Gross Income.

We Go Further Today To Help You Retire Tomorrow. Traditional and Roth IRAs give you options for managing taxes on your retirement investments. Roth ira income limits.

If the amount you can contribute must be reduced figure your reduced contribution limit as follows. The 2020 limit for contributions to Roth IRA is. Roth IRA Contribution and Income.

A Roth IRA is intended to be a retirement account so penalties apply if you misuse it by withdrawing funds too early. Eligible individuals age 50 or older within a particular tax year can make an. We Go Further Today To Help You Retire Tomorrow.

Unlike taxable investment accounts you cant put an. For 2022 the maximum annual IRA. If you file your tax return for 2022 as a single filer or head of household You can contribute up to the Roth IRA limit if your Modified Adjusted Gross Income MAGI is below.

Open A Roth IRA Today. 198000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at. Roth ira income limits.

Keep in mind that your eligibility to contribute to a Roth IRA is based on your income level. Certain products and services may not be available to all entities or persons. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

Date Title URL. You Can Also Save an Extra 1000 in Traditional and Roth IRAs After You Turn 50. Roth IRAs offer some significant tax benefits but like all tax-advantaged retirement accounts theyre subject to annual contribution limits set by the IRS.

Historical Roth Ira Contribution Limits Since The Beginning

Roth Ira Calculators

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

Is It Worth Doing A Backdoor Roth Ira Pros And Cons

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

2022 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Roth Ira Calculator Excel Template Exceldatapro

Ira Calculator Roth Cheap Sale 53 Off Www Wtashows Com

Roth Ira Calculators

Historical Roth Ira Contribution Limits Since The Beginning

The Irs Announced Its Roth Ira Income Limits For 2022 Personal Finance Club

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Roth Ira Calculators

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators